Financing refinancing: ‘s the substitute for out-of an existing personal debt duty that have an alternative obligations obligation around different terms and conditions. Loan refinancing is accomplished for several reasons plus to find a beneficial most readily useful rate of interest, combine debt, lose repayment number, etcetera.

To participate, you truly must be eligible with regards to the credit union’s world of subscription laws and regulations while making at least deposit

Loan whales is actually usurers exactly who jobs covertly, in the place of regulators controls, to ensure that people that borrow from their store have little or no individual coverage.

Business capitalization: The property value an excellent company’s the shares away from stock, those the business has also offers investors very own. Market capitalization will be called invested investment. To find an excellent businesses business capitalization, proliferate the number of offers the business keeps awarded by rates for every express.

Medicaid: A combined federal and state bodies program one covers scientific care for particular individuals who can not afford it.

Medicare: The fresh new government government’s medical insurance policy, hence pays for specific healthcare expenditures for people decades 65 or more mature and lots of handicapped customers. This new Personal Safeguards Administration manages Medicare.

Medicare income tax: The fresh new income tax one finance the Personal Cover Administration’s healthcare insurance coverage, and therefore will pay for particular fitness-worry expenses for all those decades 65 and you will old as well as specific handicapped owners.

Member: Someone who is part of a card connection. Once a part, you are a member holder, which have equivalent voting rights in the elections into the borrowing from the bank union’s shareholders, whom own shares on financial.

Loan-shark: An individual who gives somebody money and costs an extremely high interest towards the loan

Minimum wage: Minimum of amount a manager pays affected specialists, according to government rules referred to as Fair Labor Criteria Act. Particular states keeps other minimum wage criteria.

Mint: A federal government “factory” for making gold coins. Score details about the brand new You.S. perfect within the Denver and you may regarding Philadelphia mint.

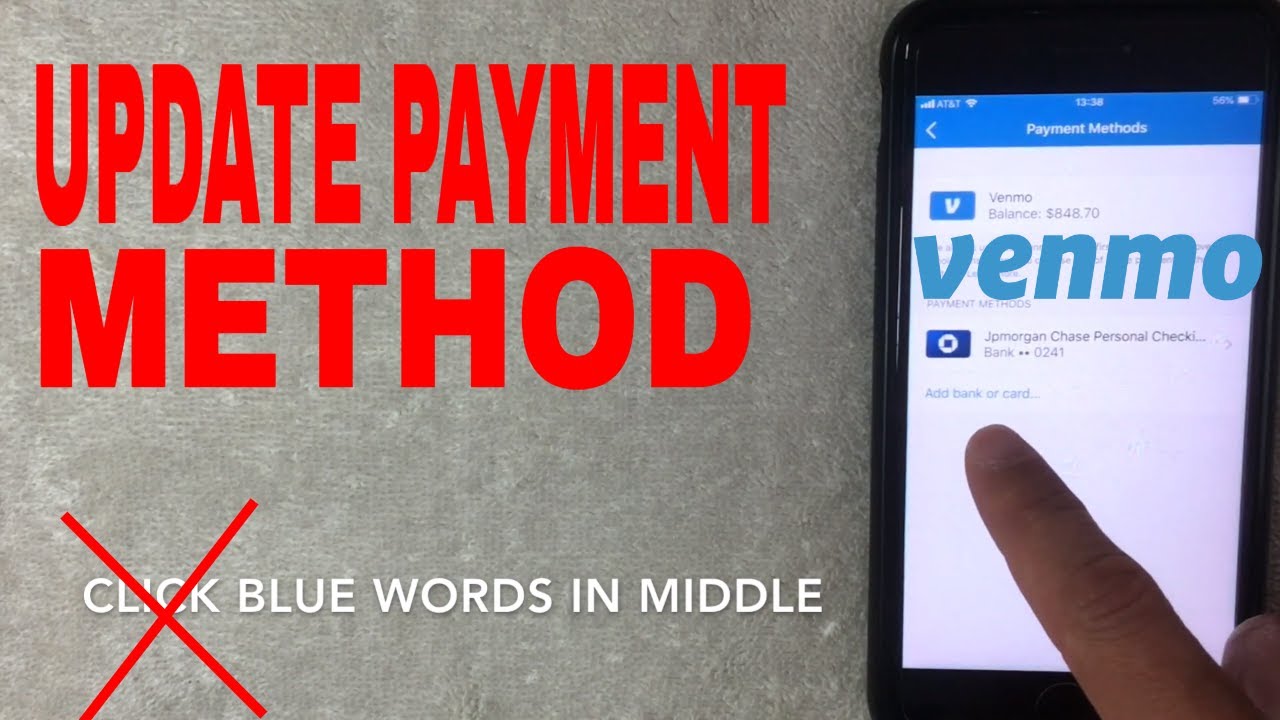

Mobile financial: Cellular banking is used having undertaking harmony inspections, account transactions, costs, borrowing software, and other financial purchases compliment of a mobile device such as for instance an effective mobile otherwise tablet.

Money sector: The device for selecting and you will selling obligations products otherwise securities with terms of less than a-year, and often lower than 1 month. Money field T-bills, and other short-identity car.

Currency field membership: Another type of form of savings account one pays higher interest levels but needs highest minimum balances and will limit how many monthly purchases.

Currency order: An appropriate document that’s a hope to invest anyone or team called on it a designated sum of money when presented within a lender. Money instructions is an alternative choice to expenses by digital financing import (EFT).

Mortgage-supported security (MBS): A trader can acquire offers when you look at the a keen MBS. The new mortgages must become from an authorized, managed standard bank and must possess higher fico scores.

Mutual financing: A financial investment you to a family makes with respect to shareholders. The organization offers offers in the fund and invests the bucks for the a group of assets, usually securities. New fund’s professionals build funding choices according to mentioned https://paydayloanalabama.com/pisgah/ objectives.

Mutual offers bank: A lender whoever depositors have it. Regardless of if a card union’s players own the credit partnership, both organizations disagree with techniques. They have additional charters and are generally at the mercy of the control off some other bodies communities. Additionally, brand new board out of directors regarding a common discounts lender is actually reduced (compared to a cards union’s volunteer directors) therefore the owners of a shared coupons financial provides voting rights in proportion towards sum of money to the put (compared to the one-member-one-choose practice of extremely credit unions).

Leave a Reply