In regards to our Pros and you may energetic-obligations armed forces employees, the fresh Virtual assistant loan system provides a different sort of possible opportunity to change homeownership towards the truth. But not, one to high component that tend to will come in is the perception regarding figuratively speaking into the Virtual assistant mortgage qualification. From the knowing the dynamics ranging from student education loans and you may Va funds, property owners helps make informed conclusion and you can overcome prospective hurdles, eventually providing all of them closer to homeownership.

Sure, college loans can enjoy a critical part on your own loans-to-earnings ratio when you are obtaining a good Va financing. Even though it is however it is possible to so you can qualify for an excellent Va loan with student loan financial obligation, you will still have to meet up with the financial conditions.

Va Financial obligation-to-Earnings Ratio and College loans

Student loans generally apply to your debt-to-money (DTI) ratio the essential whenever trying to get an excellent Virtual assistant loan. Lenders were your own education loan percentage when calculating your own monthly DTI ratio and look for missed repayments otherwise non-payments.

Lenders determine brand new DTI from the separating their complete personal debt money (also student education loans) by the disgusting monthly income. Most lenders usually favor a good DTI less than 41% for a Va loan. Highest education loan repayments increases brand new DTI, it is therefore much harder to be considered.

Just how Student loans Affect Continual earnings

Va lenders along with check your continual income and how your figuratively speaking apply to your financial situation. Continual income ‘s the income kept anyway costs and traditions expenditures is paid off. Therefore, higher student loan money can also be down residual income, causing less loans to get into paying down a Va financing.

Student loan Deferment

If you’re able to delayed otherwise delay the education loan repayments during the Va loan closing techniques then your debt may not be noticed regarding DTI proportion. It is important to keep in mind that new education loan deferment techniques can differ according to the version of debt you may have.

Such as for example, for those who have a personal education loan, it will be far better correspond with a professional Va financial to sort out the important points.

Student loan Forbearance

Education loan forbearance and enables you to briefly prevent student loan costs. Unlike education loan deferment, forbearance allows appeal in order to accrue on your own mortgage equilibrium. It could be smart to consider student loan forbearance if you never qualify for deferment.

Allowable Problem getting Student loan Forbearance

There are products where in fact the Company out-of Knowledge claims a compulsory student loan forbearance is achievable, like the pursuing the:

- You are helping inside the a healthcare or dental internship otherwise residence system and you will see particular requirements

- The total amount your debt every month for the scholar money your received are 20% or higher of one’s full monthly revenues (more criteria use)

- Youre providing in a nationwide service standing in which you gotten a nationwide service honor

- You are doing a teaching provider who does be eligible for professor loan forgiveness

- Your qualify for limited cost of your own loans under the You.S. Agencies away from Coverage Education loan Fees System

- You are a member of the brand new National Guard as well as have started activated by an effective governor, however aren’t eligible for an armed forces deferment

If you’d like assistance with these problems, speak about your options towards the student loan forbearance and/otherwise deferment together with your financing manager to see how that may apply to their Va loan application.

Va Student loan Forgiveness

Student loan forgiveness happens when you are exempt regarding settling the otherwise a portion of their student loan balance. Many reasons exist this will can be found and you can paying down college student funds And home financing may be problematic for some.

Eligible Experts and you will active-obligation solution members will get forgive its student loans from https://paydayloansconnecticut.com/niantic/ the Social Provider Mortgage Forgiveness system. The applying helps lightens beginner loans, making it possible for of a lot consumers to keep their work.

Just how to Determine Beginner Financial obligation Getting Virtual assistant Funds

Whether your figuratively speaking was deferred or perhaps in the process of becoming, give written evidence toward lender stating the student loan loans might be deferred at the very least 1 year outside of the time off closing.

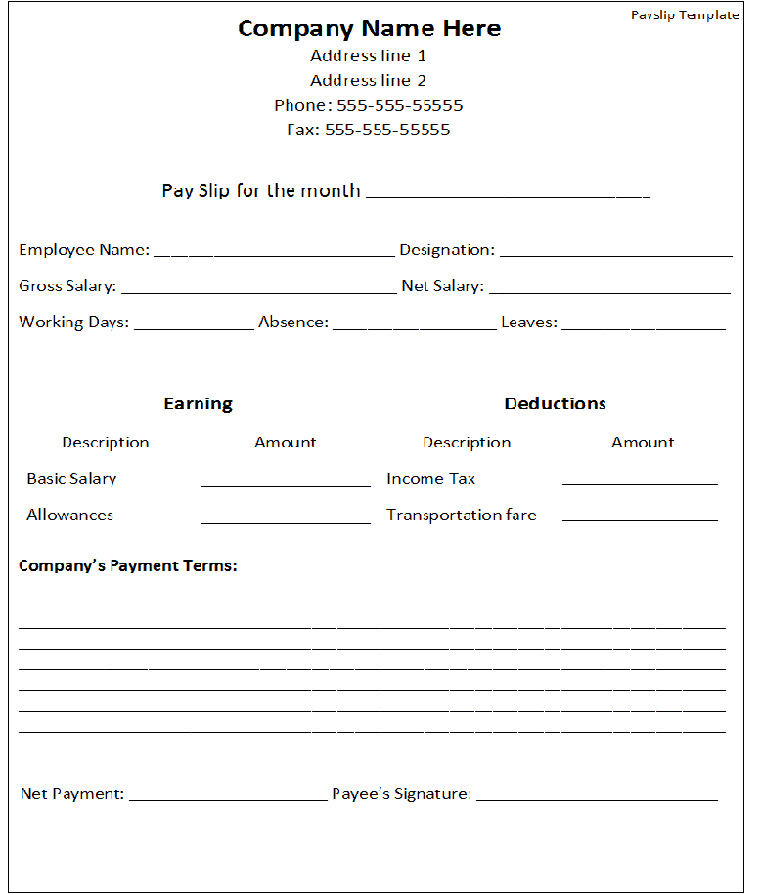

If the student loan is actually cost or booked to begin contained in this one year from the closing go out of your Va mortgage, the lender must consider the envisioned month-to-month responsibility using the following the formula:

This will give you your month-to-month student loan money. Their financial need to be sure to can invariably spend for the Va mortgage towards the top of your student obligations.

Ideas on how to Counterbalance Student loan Debt

Some Virtual assistant lenders allows you to offset the education loan personal debt that have specific compensating circumstances. For each lender varies, however, listed below are some of the most extremely common a way to offset the debt:

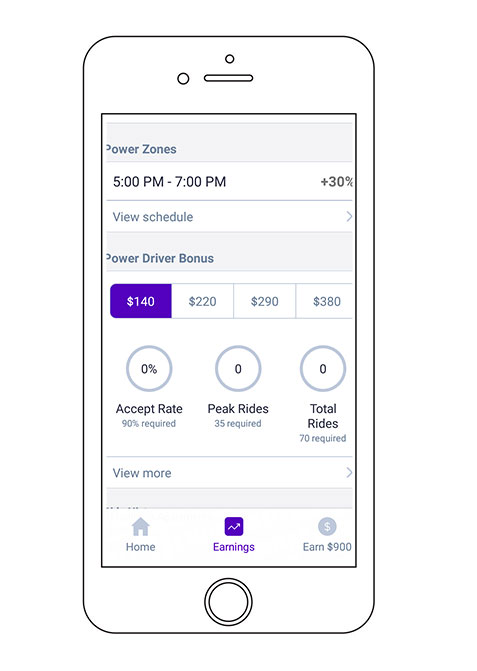

- Improve your money which have a part job otherwise co-debtor

- Help save to have an effective Virtual assistant financing downpayment

- Improve your credit rating so you can counterbalance the financial obligation

Leave a Reply