The purchase out-of a property is probably the most very important financial choices you are going to create. Whether it’s your earliest household otherwise whether you’re refinancing, there can be something you need to know: simply how much you really can afford. This is when a home loan commission calculator will come in. It is a straightforward tool that will publication and you will help you in and also make an educated decision regarding your mortgage. In this article, we are going to temporarily talk about exactly what mortgage brokers is actually and how it work; we’ll render good reason why a mortgage percentage calculator is essential when one to tries to acquire home financing.

Skills Home loans

Home financing is but one which you obtain from a financial or other lender to purchase possessions. You gradually pay-off so it loan, usually month-to-month, in the installment payments that come with one another dominant (the borrowed funds matter) and you can attract. Mortgage loans has some other terminology, interest levels, and you may formations that can influence their monthly payment.

Fixed-Speed Financial: It is the most preferred form of mortgage. The interest and monthly payments continue to be a similar to the label of the mortgage, hence creating balances and you can predictability.

Case means Variable-Speed Mortgage: The speed is actually subject to go from day to day according to the market requirements. You always begin with a low interest rate, that may raise on specific periods.

FHA Financing: Government-supported financing, designed for very first-property owners or individuals with reasonable fico scores. They need low-down payments but can increase from the a high interest rate properly.

Virtual assistant Financing: While an experienced otherwise providing into effective duty, then you may meet the requirements to get an effective Va loan. These mortgages possess selection eg straight down interest rates and you can no down repayments.

Jumbo Financing: To possess consumers regarding pricier property, jumbo loans provide highest limits regarding how much one can obtain however, commonly feature more complicated qualifications.

Expertise these types of choices would be trick, prior to you get past an acceptable limit on the application function, you’ve got to understand just how much you can afford. Which will be where a mortgage payment calculator becomes an invaluable buddy.

Home financing payment calculator helps a person to read just how much he or she pays when you look at the monthly home loan repayments mainly based on the particular variables: the borrowed funds count, interest, the size of the mortgage, and downpayment. Which device allow you to look at your month-to-month cost and and thus help in contrasting financing offers out of more lenders.

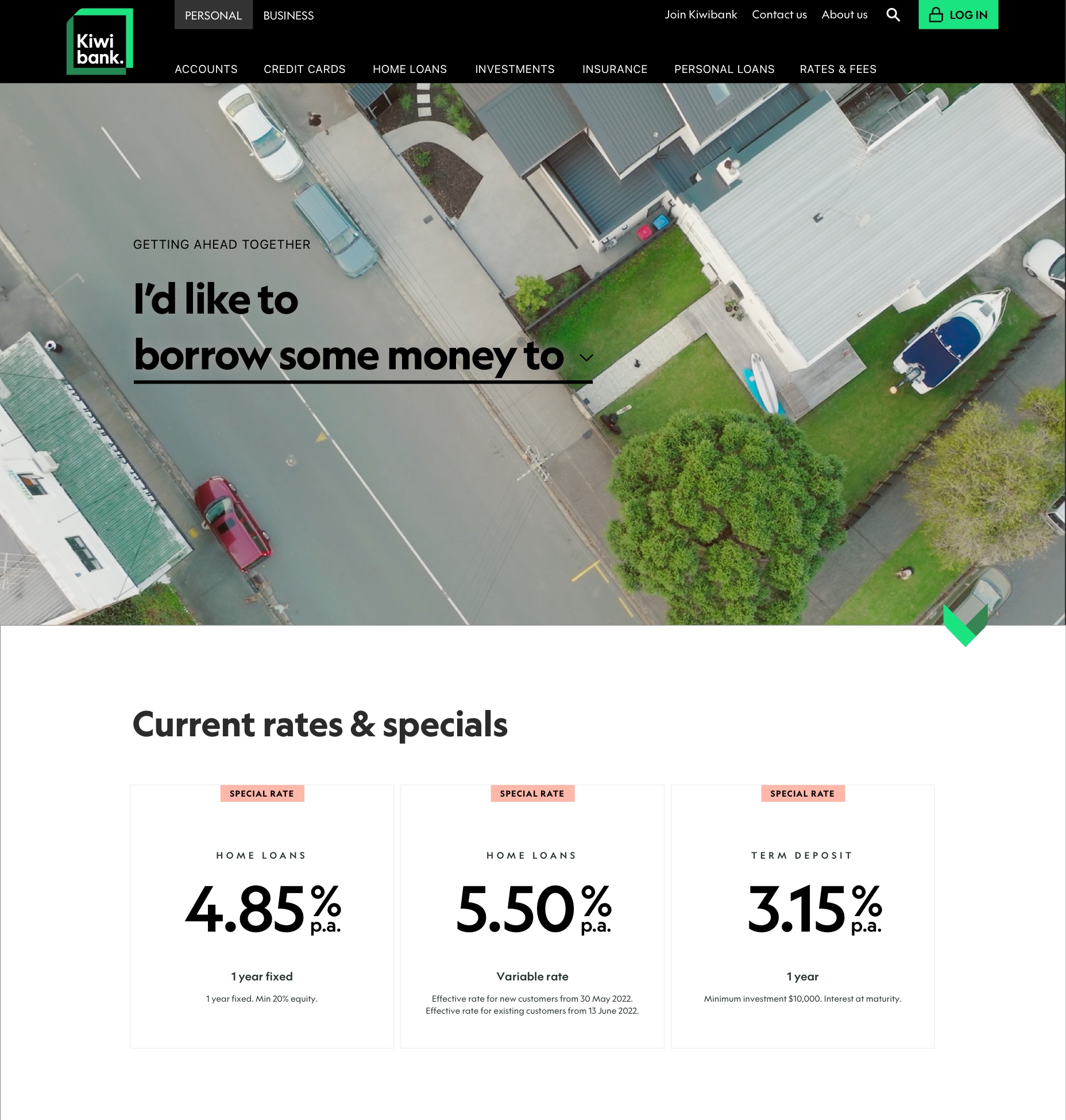

Amount borrowed: This is the overall number you are borrowing from the bank for your house. Interest rate: Mortgage depends on the sort of financing and then have into terminology of the financial. To find out more, see the current rates in your area.

Mortgage Name: This is basically the months within this you have to pay the brand new loanmon words is fifteen, web site here 20, or thirty years.

Off PaymentAmount: Here is the currency which you spend now to your the acquisition in your home. The bigger your advance payment, the newest less count you will have to acquire.

Add Possessions Taxes and you will Insurance coverage: Of several calculators together with will let you estimate any additional will cost you, such as for instance assets taxation and you will home insurance. This provides you a very complete picture of exacltly what the month-to-month payments will appear such as.

Go into which, plus the calculator will give you a keen approximation of your month-to-month mortgage repayment. That’s a fairly neat small calculation that allows one to come across just how more mortgage terms, plus deposit number, apply to your payments and eventually help you make changes into the compliance in what youre comfortable using.

Budgeting: It will let you budget realistically. You can observe far household you really can afford plus don’t stretch their money beyond constraints. Whether your projected payment per month is too large, you could to improve variables including the loan identity or down fee observe almost every other more affordable choice.

Without difficulty contrast that loan provide: The borrowed funds calculator will help you to contrast additional loans provided by various other loan providers. You will get the ability to go through every offer due to the fact plugging in different interest rates and different financing terms are very easy which have a home loan calculator.

Planning for the near future: Home financing payment calculator can supply you with a minds-up concerning future will set you back. That’s because of several hand calculators provide choices for factoring inside the property taxation, homeowners insurance, plus personal financial insurance to convey much more real views out of what your overall payment per month might look such.

Preventing Surprises: No body likes financial shocks. You might stop that one bland particular sticker surprise when your own earliest home loan costs appear, by using a home loan calculator. It is an effective way to master the things you may be investing prior to you’re taking that leap.

Loan Tailoring: Whenever you are inside a dilemma from the opting for a great 15-12 months or a 30-year home loan, which could be much better for your requirements, then your financial calculator will help you which have a visual comparison anywhere between each kind. That have a good fifteen-year loan, for each and every month’s installment count might possibly be large, since count used on attention was less. Financing drawn to own three decades will have quicker month-to-month repayments but the total cost interesting will be more compared to the rest. Having fun with a great calculator makes it possible to weighing such choices certainly.

Once you have a much better notion of exacltly what the monthly premiums could well be, you could go ahead with an increase of certainty. Here are some 2nd strategies:

Check your Credit history: It provides your credit rating, that will be significantly guilty of the rate. The higher your credit score, the higher their terms and conditions would be. If it score is not that high, then you may need to wait before applying to possess home financing, because would give your time for you improve they.

Get Pre-Approved: Pre-giving a mortgage offers vendors a sense of whether or not you are really serious or not. This may automate the process of your to order when you are prepared to make a deal.

Work at a lender: Shop around and you will consult with numerous loan providers regarding your options for that loan. After you’ve information regarding mortgage calculator, you are in a good standing so you can negotiate the newest terms of the borrowed funds in the best way.

Cause of Other Costs: There are many can cost you out of homeownership, particularly repair, repairs, and resources. Make sure your funds takes during these additional will set you back during the introduction for the month-to-month mortgage repayment.

Completion

A mortgage percentage calculator is an effective tool to simply help consumers owing to their residence-purchasing techniques with confidence. It gives a definite-slashed guess of your monthly home loan repayments, hence providing that generate wiser monetary behavior, examine various financing also provides, and eventually make certain that one selects a home loan to get results inside the finances. Before you sign one documents, make sure to fool around with home financing payment calculator; it really home obligations.

Leave a Reply